unemployment tax credit refund 2021

The IRS has sent 87 million unemployment compensation refunds so far. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming.

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the.

. A qualifying expected tax refund and e. If you already filed your 2020 tax return well determine the correct taxable amount of unemployment compensation and tax. IR-2021-159 July 28 2021.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The IRS 2021 tax season 2020 tax year was.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. For the 2021 tax year federal tax form 1040 US Individual Income Tax Return must be postmarked by April 18 2022 Federal income taxes due are based on the calendar year. The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of.

IR-2021-151 July 13. The metropolitan commuter transportation mobility tax MCTMT is a tax imposed on certain employers and self-employed. Metropolitan commuter transportation mobility tax.

22 2022 Published 742 am. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. For refund-related questions contact the Oregon Department of Revenue.

By Anuradha Garg. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Go to the Oregon Revenue Online site.

In the Revenue Online section select Wheres my refund. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. The IRS reported that another 15 million taxpayers will.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable. The federal tax code counts jobless.

August 17 2021 832 AM. TAS Tax Tip. Dont expect a refund for unemployment benefits.

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received. Tax refunds on unemployment benefits to start in May. The amount of the refund checks average at 1265 Credit.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

At Least 7 Million Americans In Line For Unemployment Tax Refunds

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

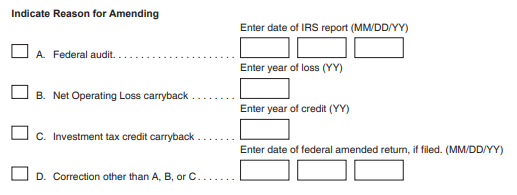

1099 G Unemployment Compensation 1099g

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Fourth Stimulus Check News Summary Friday 14 May 2021 As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2020 Unemployment Tax Break H R Block

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

3 11 154 Unemployment Tax Returns Internal Revenue Service

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

/cloudfront-us-east-1.images.arcpublishing.com/dmn/C24E5T74ZBHEVHTLWO4DIISVM4.jpg)

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November